Our Services

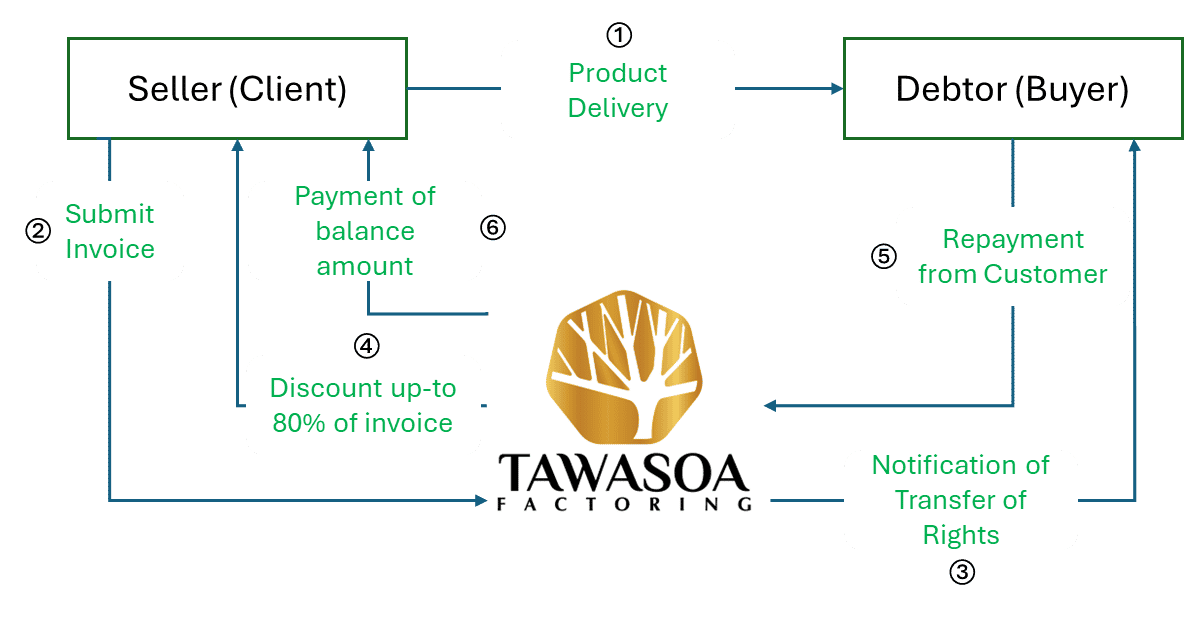

Direct Factoring:

A factoring contract is conducted between Tawasoa Factoring and the Seller to which:

1. The Seller assigns to Tawasoa their receivables, which arises from contracts of sale or services made between the Seller and its customers (buyers).

2. Tawasoa advances or discounts the sellers’ invoices/Post Dated Checks at a rate in exchange for a discount.

3. Tawasoa is to perform at least one of the following functions: finance based on receivables, maintenance of accounts relating to the receivables and collection of receivables.

Note: Notification to debtor is mandatory in case of domestic-classical-recourse factoring

Reverse Factoring:

Reverse factoring, also known as supply chain financing or supplier finance, is a financial arrangement where a buyer partners with a Tawasoa to help its suppliers receive early payments for their invoices following the below process:

1. Supplier Delivers Goods or Services: The supplier provides goods or services to the buyer and submits an invoice for payment.

2. Buyer Approves the Invoice: Once the buyer receives the invoice and approves it, the buyer notifies Tawasoa that the invoice is valid, and payment will be made at the agreed-upon due date.

3. Early Payment to Supplier: With the buyer's confirmation, Tawasoa offers the supplier an option for early payment (minus a small discount or fee). This means the supplier receives cash earlier than the original due date without having to wait for the buyer’s standard payment terms.

4. Payment from Buyer to Financial Institution: On the invoice's original due date, the buyer pays Tawasoa the full invoice amount.